It has been quite a while since the last post.

So there will be occasional update on the strategy BUT it has since been improvised.

And looking forward to how this newly improvised strategy will work in the long run, and if all goes smooth and making good results, I will be making a new fresh website for this strategy.

But most important of all, it is not the strategy itself that makes it successful. It is how you manage your trades and money. Money management is the essence. I will be more in-depth about it on my next post.

As for this strategy, the development is still on-going. As to how to limit losses and creating successful gains.

As of now, we are still using the "Set & Forget" strategy. Where you can easily manage trades without the need to be in a rush to enter trades. Good for those working, great for those who have time to explore this particular strategy.

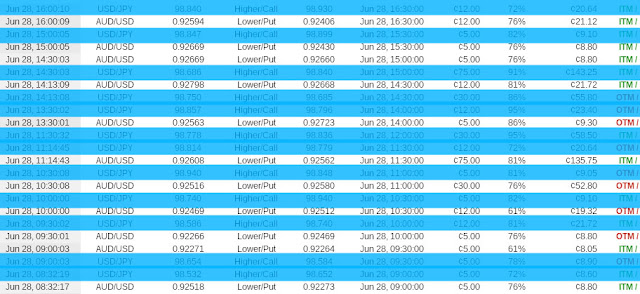

So here it is:

We are using 3 pairs.

AUD/USD | NZD/USD | USD/JPY

As I am working within the Asian Session, I can monitor anytime when I want.

To place a trade, I will be putting 2 pending positions, Buy and Sell at X pips above or below the Close from the previous candlestick (0700hrs GMT+8 candlestick).

As shown in the screenshot below.

My time is at 0700hrs when the candlestick CLOSE) So we will place positions at 0700 hrs.

The Terminal shown below is the candlestick opens at 0100 GMT)

Don't be confused.

Just place positions at 0700hrs GMT+8. It is early in my country, and perhaps night at yours.

Place Positions:

For AUD/USD & NZD/USD:

Place Buy Stop position 27-28 pips (account for the spread) from the Close Price of the Candlestick that we mentioned above.

Once set the Position price, set the TP and SL at 20 pips.

For USD/JPY:

Place Buy Stop position 37-38 pips (account for the spread) from the Close Price of the Candlestick that we mentioned above.

Once set the Position price, set the TP and SL at 20 pips.

Why do we need to wait that amount of pips before placing a trade?

As we trading in the Asian Session, price will start to move within this trading hours. Especially these currency pairs.

And trend will start to build up after an amount of pips, so I am finding trends in terms of volume rather than overall trend. As we are looking only at 20 pips each day, we will not need to wait that long to capture that 20 pips.

IF your position has been triggered, let it run and IF it has not hit any SL or TP before 0700hrs GMT+8 on the NEXT day. Close that trade. We need to open a new trade position on a new day.

Try and backtest, I have backtested this from the start of 2013. Check it out my Excel file below.

New System Back Test Excel File

As you can see, there are some losses for the month on certain pair. While the consistent pair is AUD/USD.

However, overall with 3 currencies, we are in the

GREEN. While this is still in development stage, we are excited to bring in any

GOOD news to make it a fairly

GREAT system for all to use.

Some of you might say, this is the same as most breakout or trend following strategy.

I say, Yes, you may be right. BUT you may be loss of information on the management part.

We have trade in place, so Trade management is settled. Next is ....

MONEY MANAGEMENT

And that will in the Next post. So stay tune!